In August 2025, the Federal Office for Agriculture (FOAG) published its ‘Market Report on Organic Products with a Focus on Animal Products and Plant-Based Alternatives’ based on data from the NielsenIQ Switzerland household and retail panel and the Biobarometer study.1 Total sales in the Swiss organic market remained stable in 2024. The organic share rose particularly in meat alternatives, while it declined in milk alternatives, with consumers shifting towards non-organic products.

Overview of the Swiss organic market

The Swiss organic market remained stable overall in 2024. Both sales and volumes grew slightly – in contrast to 2023, when growth was driven mainly by price increases. Organic products accounted for around 11.6% of total food retail sales. Organic products are particularly well represented in traditional retail (13.5% share), while specialist retailers (12.4%) and discounters (3.8%) have smaller shares. Traditional retail remains the most important channel with 88.2% of the market, followed by discounters (6.2%) and specialist retailers (5.7%).

High organic share for plant-based meat alternatives

The product group with the highest sales is ‘cereals and baked goods’, followed by vegetables and potatoes in second place. Dairy products, including alternatives, rank third, and meat and fish, including alternatives, rank fifth. The ‘oil and fat’ product group recorded particularly strong relative growth.

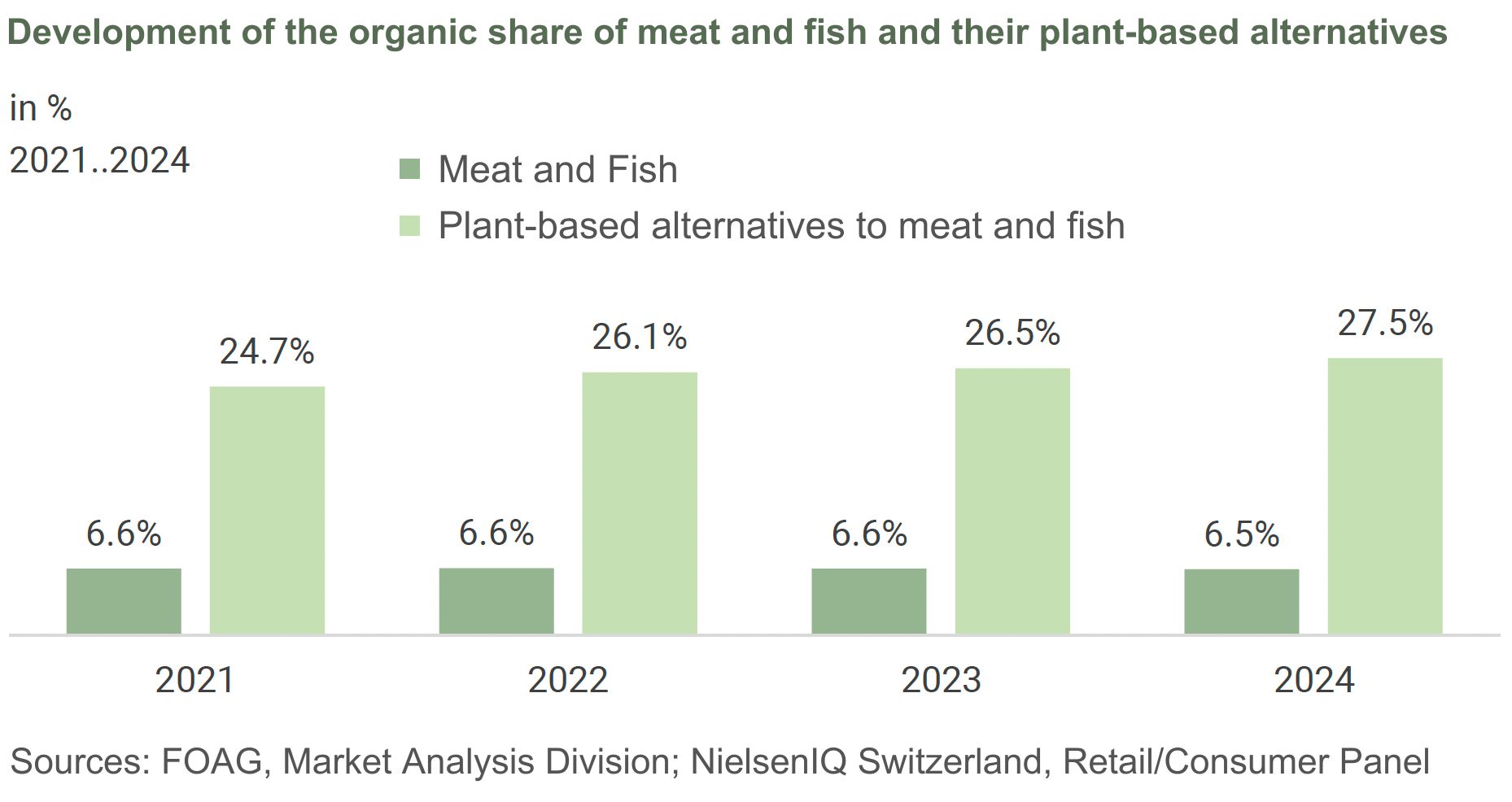

Although many consumers claim to prioritize organic quality in meat, fish, and dairy, actual purchasing behaviour shows otherwise. In contrast, alternatives to meat and fish have a particularly high organic share of 27.5%, while this figure is only 6.5% for meat and fish.

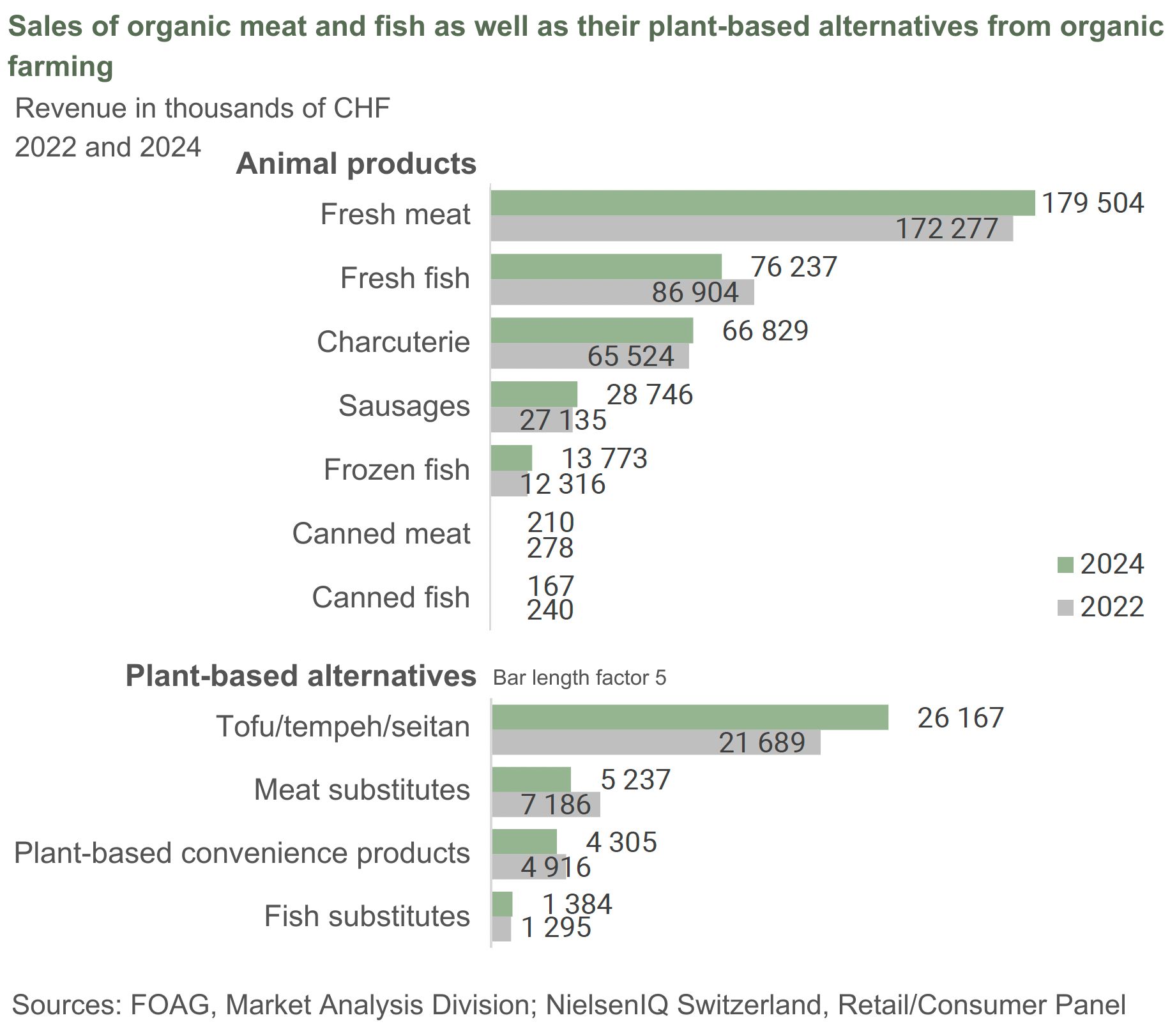

Tofu, tempeh, and seitan are especially popular in the organic segment and have shown clear growth over the last two years. By contrast, sales of meat substitutes and plant-based convenience products declined, while fish substitutes remain the smallest category but posted slight growth.

Current market figures also point towards growing interest in meat alternatives: according to Coop’s latest Plant Based Food Report, they represent the second-largest category in the vegan market after milk alternatives. Around 57% of the Swiss population has already tried vegan alternatives, and 30% consume them regularly.2

Plant-based dairy products: Non-organic particularly popular

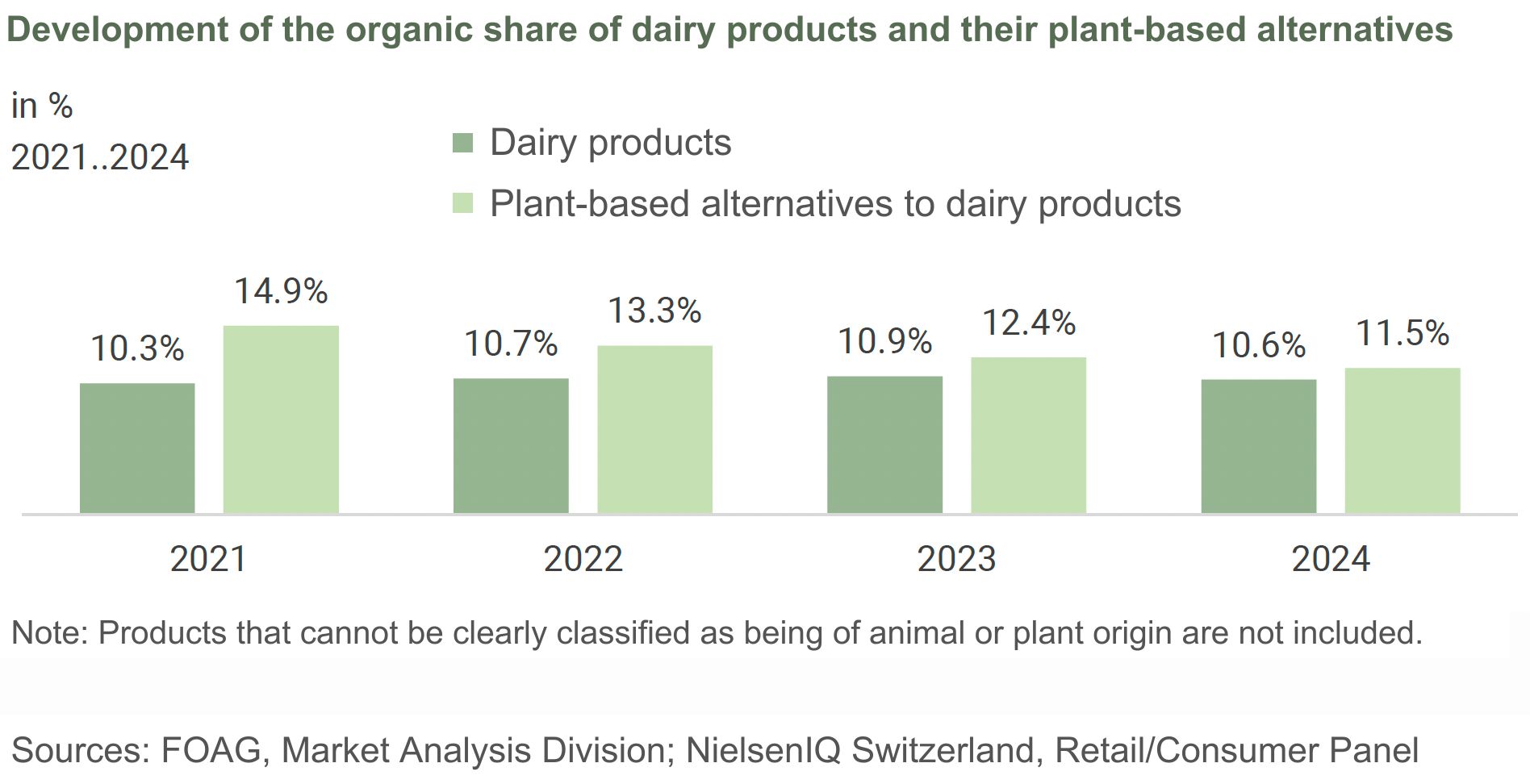

For dairy products and their alternatives, the difference in the organic share is only 0.9 percentage points. Dairy products have had a relatively stable organic share over the last few years, which stood at 10.6% in 2024. For plant-based alternatives, on the other hand, the trend is downward: from 13.3% in 2022 to 11.5% in 2024.

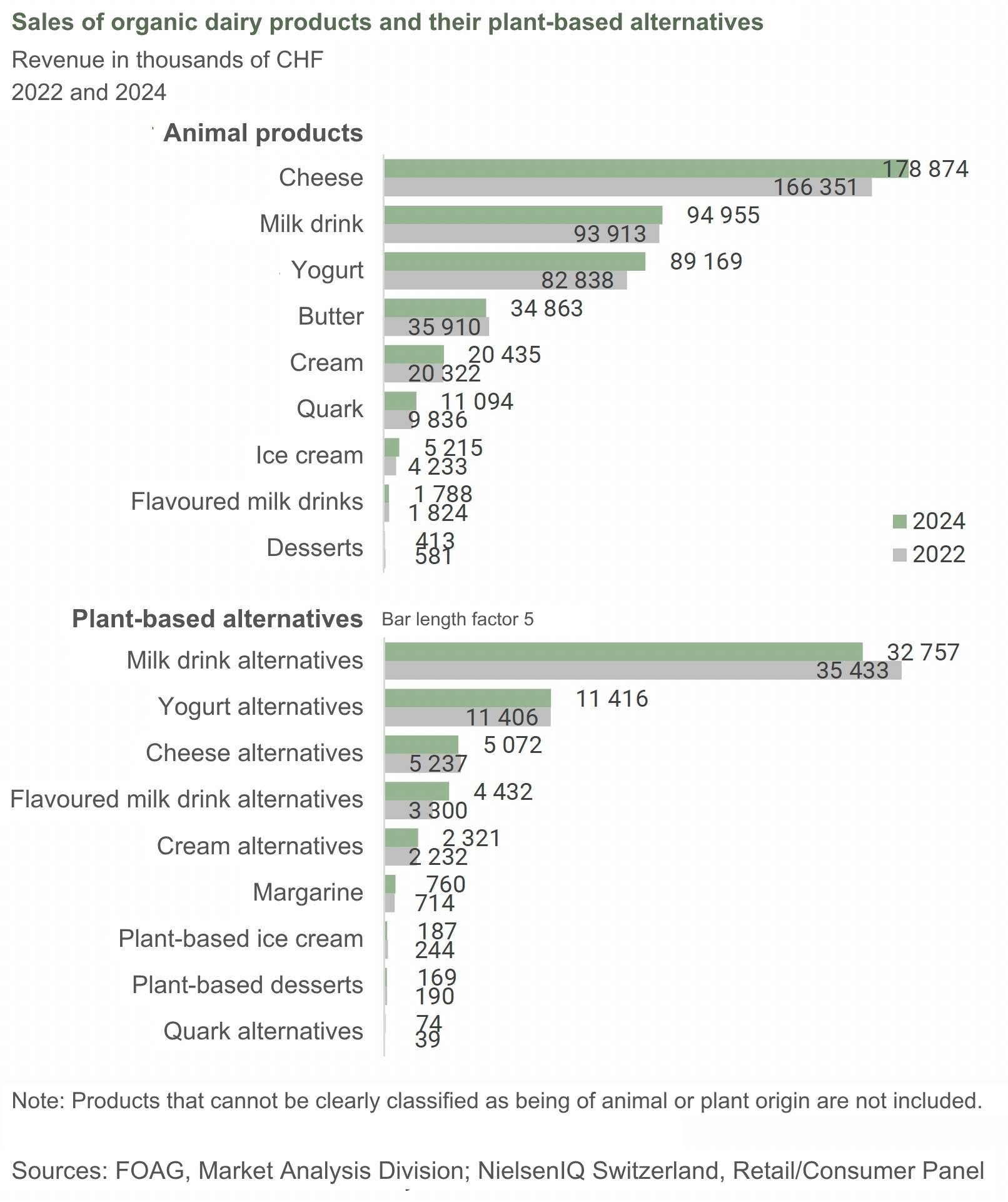

Plant-based milk drinks remain the strongest group within organic dairy alternatives. However, sales in this segment have fallen by an average of 3.9% per year. In the non-organic segment, by contrast, sales rose by 14.5% annually. Per capita spending on plant-based milk rose from CHF 43.1 in 2022 to CHF 48.3 in 2024 – mainly driven by non-organic products. Since 2017, demand for milk substitutes in Switzerland has more than doubled, with oat milk now the best-selling plant-based milk.3

Within organic milk alternatives, yoghurt ranks second after milk drinks, followed by cheese and flavoured milk drinks. Quark alternatives remain the smallest category, but are showing particularly strong growth (+37.9%).

More and more organic consumers

The share of consumers with high organic consumption grew steadily from 46% in 2020 to 55% in 2024. Accordingly, the low and medium consumption groups declined. Price continues to be the main barrier to organic purchases.

The motives for buying organic have remained unchanged since 2022: the most important personal reasons are avoiding synthetic pesticides, healthy eating, and fewer additives. Among sustainability-oriented motives, avoiding preventive antibiotic use in livestock farming, species-appropriate animal husbandry, and environmentally friendly production remain key drivers.

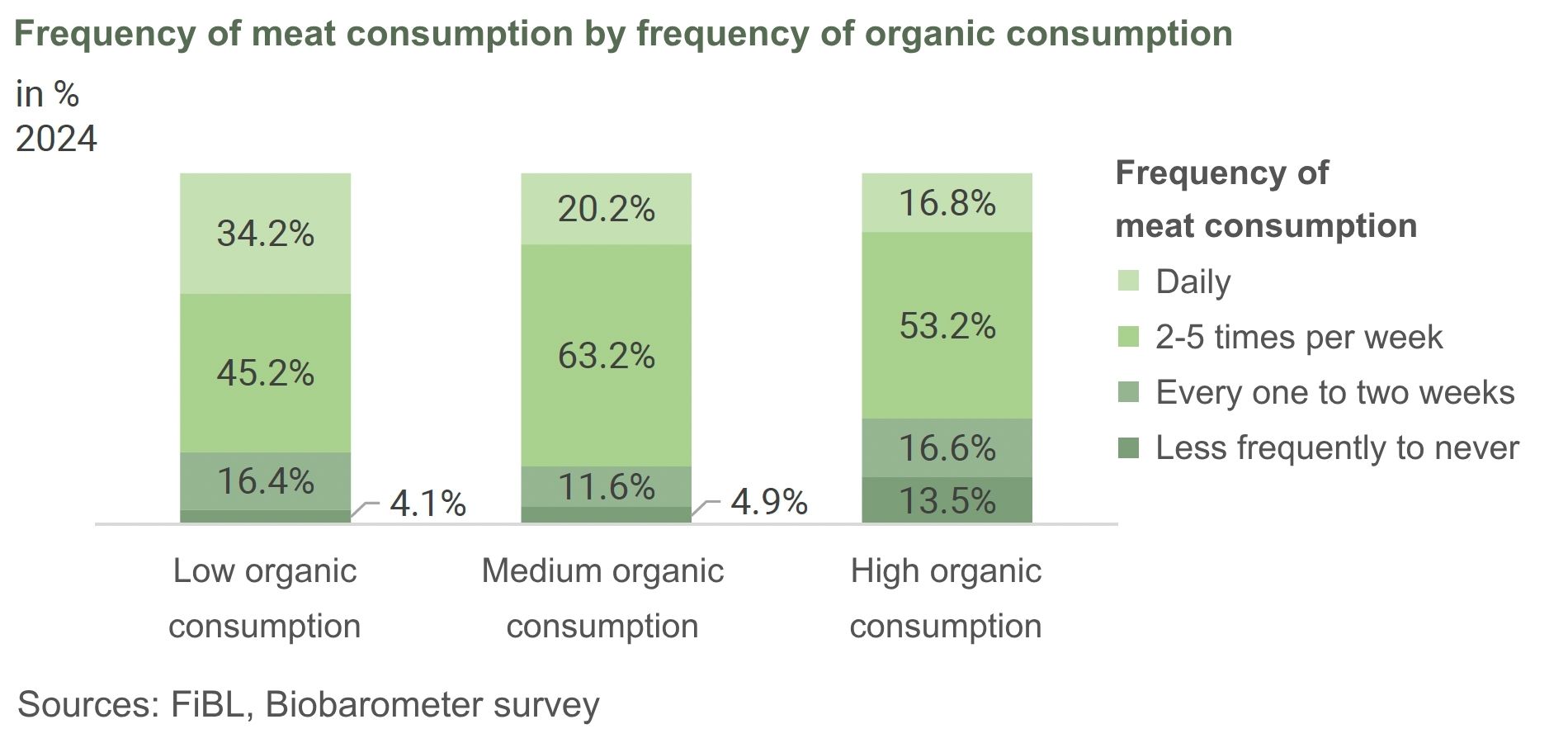

Organic consumers eat less meat – and more vegan meals

Meat consumption has declined most sharply among consumers with high organic intake – a trend also confirmed by the Biobarometer survey. Those who rarely buy organic products eat meat more frequently than heavy organic consumers. This correlation has strengthened in recent years: in 2020, 12.3% of high organic consumers reported eating meat less than once every two weeks; by 2024, this had risen to 13.5%.

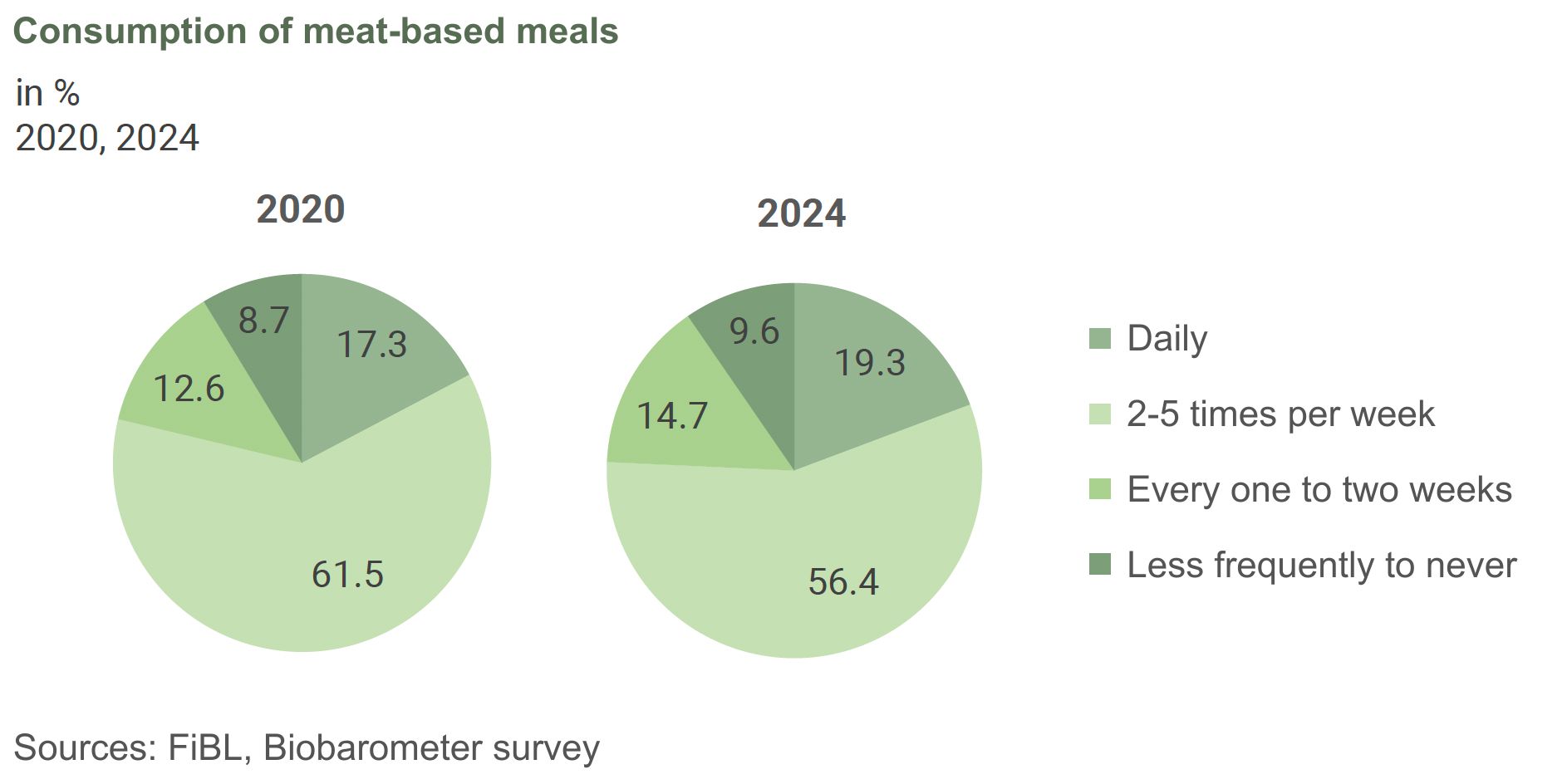

Overall, the share of respondents consuming meat less than once every two weeks or never rose by 0.9 percentage points between 2020 and 2024. The group eating meat only once every one to two weeks increased by 2.1 percentage points. Meanwhile, the largest group – those eating two to five meat-based meals per week – declined by 6.1 percentage points, from 61.5% to 56.4%.

The consumption of vegan meals is also highest among strong organic consumers and increased between 2020 and 2024. The share eating vegan meals every one to two weeks rose from 8.4% to 12.8%, while daily vegan meal consumption climbed from 4.1% to 5.4%.

Possible trends and purchasing preferences

As the report shows, total sales in the Swiss organic market remained stable in 2024, with organic products accounting for around 11.5% of the market. Plant-based organic products such as quark alternatives, tofu, tempeh, and seitan recorded sales gains, while organic meat and milk alternatives lost ground. The organic share of meat alternatives rose, while that of milk alternatives declined in favour of non-organic products.

One possible reason is fortification: organic milk alternatives are rarely enriched with nutrients, whereas non-organic products are usually fortified with calcium and vitamin B12.

The share of high organic consumers is rising, while meat consumption is falling particularly in this group. The boom in minimally processed alternatives such as tofu, tempeh, and seitan suggests that ecological criteria and low processing levels may be important drivers of purchasing preferences.

- Bundesamt für Landwirtschaft und Forschungsinstitut für Biologischen Landbau. (2025). Bio-Konsum 2024: Stabilisierung auf

hohem Niveau. https://www.agrarmarktdaten.ch/blog/bio-konsum-2024-stabilisierung - Coop. (2025). Plant Based Food Report: Studie zum veganen Genuss in der Schweiz. www.coop.ch/de/marken-inspiration/ernaehrung/vegetarisch-vegan/vegane-ernaehrung/report.html

- News Service Bund. (2022). Milchersatzprodukte immer beliebter. https://www.news.admin.ch/de/nsb?id=89701